The Ultimate Guide to College Grants: An Essential Handbook

Navigating the financial challenges of obtaining a reputable college education can be overwhelming, particularly for students belonging to low-income households. However, grants emerge as a beacon of hope, relieving the monetary pressure and enabling students to finance an education they once deemed impossible.

Grant or Scholarship?

Grants and scholarships are frequently mentioned together, but the attributes of grants can make them a preferable choice for specific students. One key similarity is that both grants and scholarships do not need to be repaid. However, scholarships are usually based on merit or exceptional accomplishments, while grants are predominantly awarded based on the student's financial need.

What’s In This Guide

What’s The Difference

Scholarships

Often based on merit or achievement

Often based on merit or achievement

Don’t require repayment

Don’t require repayment

Grants

Based solely on need

Based solely on need

Don’t require excellent grades or athletic ability

Don’t require excellent grades or athletic ability

Don’t require repayment

Don’t require repayment

Source: https://studentaid.ed.gov/sa/about/data-center/student/application-volume/fafsa-school-state

Gauging Eligibility Factors

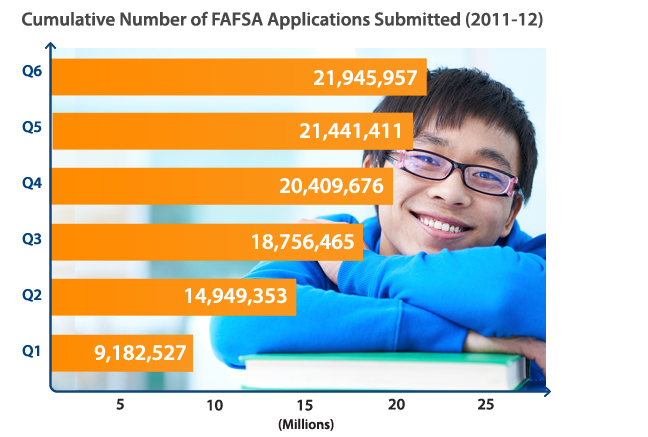

With grants primarily considering need as the basis, accurately assessing a family's financial health becomes essential, and it is equally vital for schools to employ a consistent metric when evaluating the needs of multiple students. The Free Application for Federal Student Aid (FAFSA) fulfills this role by requiring students to complete the form annually. Not surprisingly, officials receive hundreds of thousands of these forms each year.

Students who fill out the FAFSA are not just seeking federal aid but also establishing their eligibility for a variety of funding opportunities, including those offered by private organizations. Nevertheless, it is important to recognize that federal sources often provide the most substantial grants.

Pell Grants

Undergraduate students who exhibit financial need and do not hold a bachelor's or professional degree are eligible for Federal Pell Grants. While these grants can be crucial, the American Association of State Colleges and Universities indicates a decline in the proportion of tuition covered, currently at only 36% of the cost. By comparison, in 1976, these grants covered approximately 72% of the cost.

Pell Grants offer a high degree of portability, enabling students to apply them at virtually any educational institution that accepts federal financial aid. The National Center for Education Statistics reports that over 6,000 schools fall within this category.

Other federal programs may be available at institutions like these, making these grants appealing to individuals who may or may not meet the qualifications for a Pell Grant.

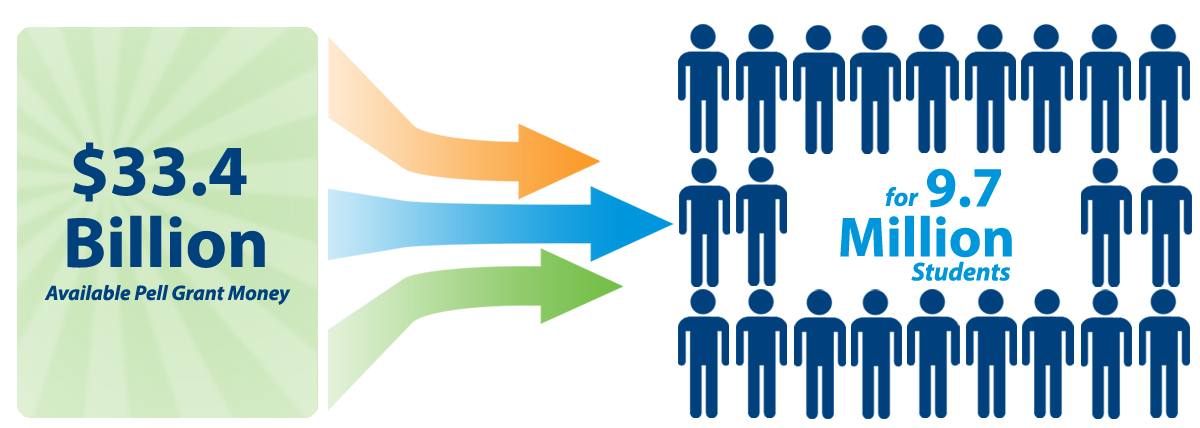

Even with that said, the Pell Grant program has the power to impact 9.7 million students and offer substantial financial assistance, totaling an impressive $33.4 billion.

Secondary Federal Grants

The Federal Supplemental Educational Opportunity Grant is designed to aid undergraduate students who can demonstrate an exceptionally high level of financial need, as determined by officials. The grant amount provided can vary dramatically, ranging from $100 to $4,000, depending on the extent of need exhibited by the student, according to the U.S. Department of Education.

- Foreign languages

- Math

- Reading

- Science

- Special education

- Bilingual education

- English as a second language

Private Grants

While federal grants are valuable, students in need should consider the availability of state grants as well. States like Virginia offer undergraduate grants up to $3,100 and graduate grants up to $1,500, whereas Texas provides grants ranging from $2,400 to $7,400.

Virginia – 2013-14

Undergraduate Students: $3,100

Undergraduate Students: $3,100

Graduate Students: $1,500

Graduate Students: $1,500

Source: http://www.schev.edu/

Texas – 2012-2013

State College Students: $7,400

State College Students: $7,400

Community College Students: $2,400

Community College Students: $2,400

Technical College Students: $4,400

Technical College Students: $4,400

Moreover, there are grants that take into consideration various aspects of a student's life, such as their:

- Ethnicity

- Cultural affinity

- Work background

- Family circumstance

- Chosen course of study

These grants can be equally advantageous as the federal government's offerings. For instance, the Patsy Takemoto Mink Education Foundation provides education grants of up to $3,000 to low-income women with children.

Dispelling Grant Myths

The idea of receiving a predetermined sum of money without the obligation of repayment may sound exceptionally appealing, resulting in the dissemination of various myths regarding the functioning of grants in cyberspace. However, these myths can deter students from accessing the necessary financial aid, underscoring the significance of dispelling them.

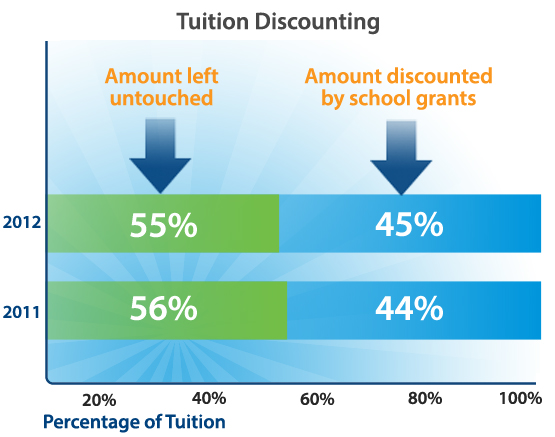

An erroneous belief is that the available grant funding declines annually, causing certain students to mistakenly avoid applying. Nevertheless, the National Association of College and University Business Offices, as reported by Inside Higher Ed, has clarified that this perception is inaccurate.

These statistics are considered "unprecedented" by experts, with price sensitivity from students and their parents being the driving force behind them. As families become more adept at evaluating their options, they may increasingly prioritize grants as a determining factor when selecting a college or university. Notably, educational institutions appear to be receptive to these evolving expectations.

Should I Schedule a Visit to the Financial Aid Office?

It is important for students to realize that their changing circumstances can indeed merit another visit to the financial aid office, as they might be eligible for additional funds that can assist them in financing their education.

According to University Business, the U.S. Department of Education emphasizes the significance of students proactively reaching out to their financial aid office when faced with severe financial hardships. Such challenges may include scenarios like:

- Employment changes

- Foreclosure

- Death of a breadwinner

- Unexpected medical bills due to a costly illness

In situations where a student's financial circumstances change dramatically, it is beneficial to reach out to the financial aid office to explore all available funding sources, such as the Pell Grant, which is provided to eligible students.